The wage peak system refers to the gradual reduction of wages for senior workers in return for continuing employment after they reach a certain age. While there has as yet been no clear academic definition of the wage peak system, it is generally considered to be a tool to lower the wages of senior workers in alignment with their reduced level of productivity, while at the same time providing them with job security.

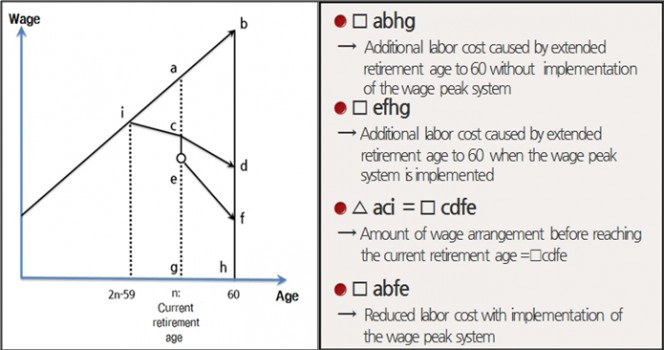

In particular, as the wage systems of most Korean companies are currently based on seniority and a set wage level according to the worker’s age or years of service, the wage peak system is accepted as one solution for corporate in Korea to relieve the increasing financial burden created by extension of the retirement age to 60, coupled with a rigid wage system. Given that the seniority-based wage system allows older employees to receive a higher salary and additional fringe benefits, it is a fact that extension of the mandatory retirement age to 60 would put an excessive financial burden on companies in the immediate future, so that they cannot help but adopt the wage peak system in order to survive. Under these circumstances, the Korean Employers Federation has developed a new model of wage peak system, the ‘KEF Wage Peak System Model,’ to provide companies with guidelines.

1. Cases of Korean Companies

As of 2012, the implementation rate of the wage peak system stood at 16.3% in Korea. This means that, among workplaces with 100 or more employees, over 1,600 companies had adopted the wage peak system, an increase from 2.3% in 2005.

[Figure 1] Implementation Rate of the Wage Peak System in Korea

* Note: Data is from a survey of workplaces with 100 or more employees

* Source: Ministry of Employment & Labor

2. Process of the KEF Wage Peak Model

|

STEP 1. Calculate the additional direct labor cost of employees with the extended retirement age

|

|

When ‘n’ means the current retirement age, and ‘w’ means the average wage of employees aged ‘n’,

The amount of additional financial burden due to the extended retirement age = [the number of employees aged ‘n’ + the number of employees aged ‘n-1’ + … the number of employees aged ‘2n – 59’] × w

|

|

STEP 2. Determine the level of financial burden that the company can bear

|

|

Considering that each company will have variations in such areas as net profit margin and debt ratio, the KEF suggests the proportions of financial burden that a company might have to shoulder from the additional labor costs resulting from the extended retirement age.

|

| Net Profit Margin | Basic Burden Rate (A) | Debt Ratio | Premium Rate (B) |

| Under 0% | 30% | under 100% | 25% |

| Under 2% | 35% | ||

| under 200% | 20% | ||

| Under 4% | 40% | ||

| Under 6% | 45% | under 300% | 15% |

| Under 8% | 50% | ||

| 300% or more | 10% | ||

| 8% or more | 55% |

|

Company burden rate = b (net profit margin reflected) + additional rate (debt ratio reflected) ± adjustment

|

|

Ex. 1) In case of a company with 3.5% net profit rate and 250% debt ratio company burden rate is 55% (40% basic burden rate + 15% additional rate). 10% is added for production workers in the company, so the rate for production workers is 65% while it is 55% for nonproduction workers.

|

|

Ex. 2) For a company with net profit rate of 8% and debt ratio of 150%, the burden is 75% (55% basic burden rate + 20% additional rate). If the company’s retirement age is 55 years of age, 10% is subtracted. Finally, the company burden rate is 65%.

|

|

STEP 3: Set payment rate

|

The average wage under the extended retirement (D)

|

This model displays the amount that a company has to pay during the period of extended retirement age. Companies may set the rate by age on their own. The following is the KEF suggestion.

|

3. KEF Wage Peak Model (e.g. 60% company burden)

|

Existing Retirement

Age

|

Prior to the Existing Retirement Age

|

Extended Working Years under Retirement Age Extension

|

|||||

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

|

|

Age 55

|

85%

|

85%

|

75%

(age 56)

|

70%

(age 57)

|

65%

(age 58)

|

60%

(age 59)

|

60%

(age 60)

|

|

Age 56

|

85%

|

85%

|

75%

(age 57)

|

70%

(age 58)

|

65%

(age 59)

|

60%

(age 60)

|

|

|

Age 57

|

85%

|

85%

|

80%

(age 58)

|

70%

(age 59)

|

60%

(age 60)

|

||

|

Age 58

|

85%

|

85%

|

80%

(age 59)

|

70%

(age 60)

|

|||

|

Existing Retirement

Age

|

Prior to the Existing Retirement Age

|

Extended Working Years under Retirement Age Extension

|

||||

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

|

|

Age 55

|

100%

|

70%

(age 56)

|

65%

(age 57)

|

60%

(age 58)

|

55%

(age 59)

|

50%

(age 60)

|

|

Age 56

|

100%

|

70%

(age 57)

|

65%

(age 58)

|

55%

(age 59)

|

50%

(age 60)

|

|

|

Age 57

|

100%

|

70%

(age 58)

|

60%

(age 59)

|

50%

(age 60)

|

||

|

Age 58

|

100%

|

65%

(age 59)

|

55%

(age 60)

|

|||

|

Existing Retirement

Age

|

Prior to the Existing Retirement Age

|

Extended Working Hours under Retirement Age Extension

|

|||||

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

|

|

Age 55

|

85%

|

85%

|

75%

(Age 56)

|

70%

(Age 57)

|

65%

(Age 58)

|

60%

(Age 59)

|

60%

(Age 60)

|

|

Age 56

|

85%

|

85%

|

75%

(Age 57)

|

70%

(Age 58)

|

65%

(Age 59)

|

60%

(Age 60)

|

|

|

Age 57

|

85%

|

85%

|

80%

(Age 58)

|

70%

(Age 59)

|

60%

(Age 60)

|

||

|

Age 58

|

85%

|

85%

|

80%

(Age 59)

|

70%

(Age 60)

|

|||

[Case 2] Payment rate by age if wages are adjusted only for the extended working years under the retirement age extension

|

Existing Retirement

Age

|

Prior to the Existing Retirement Age

|

Extended Working Hours under Retirement Age Extension

|

||||

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

|

|

Age 55

|

100%

|

70%

(Age 56)

|

65%

(Age 57)

|

60%

(Age 58)

|

55%

(Age 59)

|

50%

(Age 60)

|

|

Age 56

|

100%

|

70%

(Age 57)

|

65%

(Age 58)

|

55%

(Age 59)

|

50%

(Age 60)

|

|

|

Age 57

|

100%

|

70%

(Age 58)

|

60%

(Age 59)

|

50%

(Age 60)

|

||

|

Age 58

|

100%

|

65%

(Age 59)

|

55%

(Age 60)

|

|||